Overview of Bank of Baroda (BOB) Share Price Performance

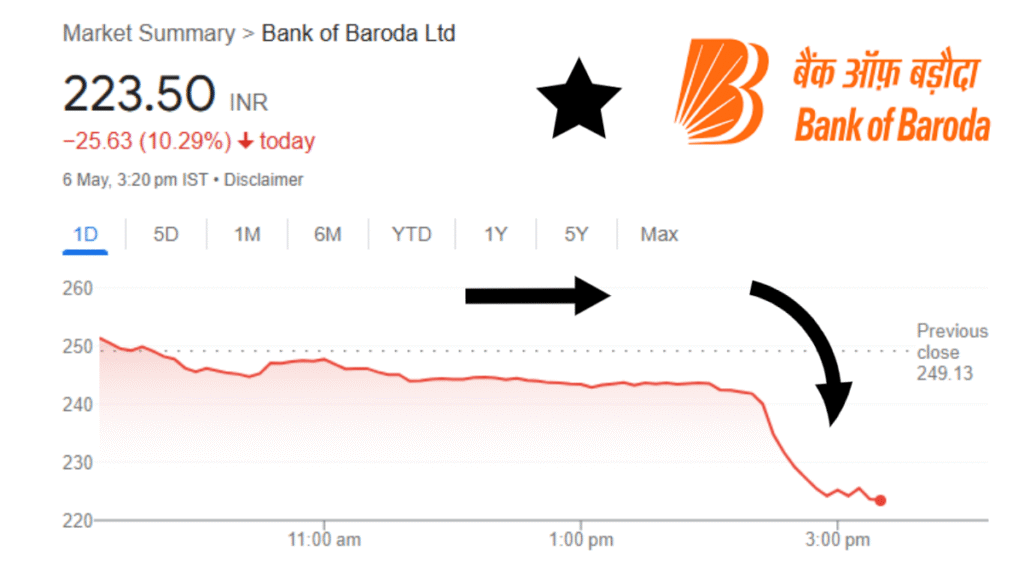

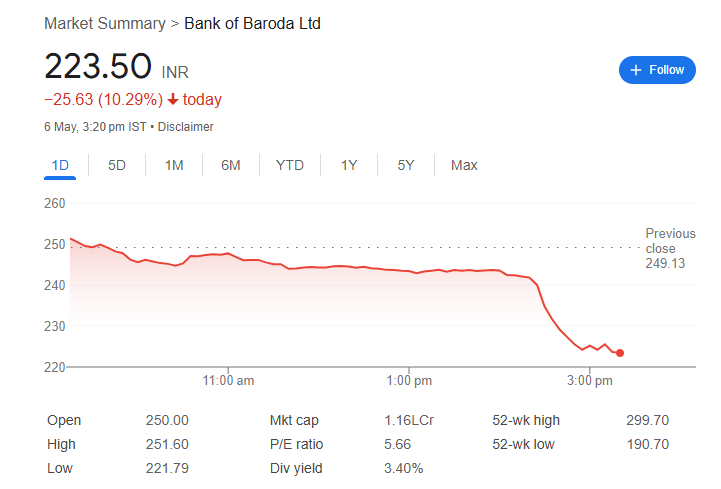

Bank of Baroda (BOB), one of India’s leading public sector banks, has consistently been a focus for investors due to its robust fundamentals and extensive presence in the Indian financial sector. As of May 6, 2025, the Bank of Baroda share price closed at ₹223.50, marking a significant decline of 10.29% during the day’s trading session. This sharp drop has sparked interest in understanding the factors driving this movement and the future prospects of BOB shares.

Opening Price: ₹250.00

Day’s High: ₹251.60

Day’s Low: ₹221.79

Previous Close: ₹249.13

Market Cap: ₹1.16 Lakh Crore

P/E Ratio: 5.66

Dividend Yield: 3.40%

52-Week High: ₹299.70

52-Week Low: ₹190.70

Recent News Impacting Bank of Baroda Share Price

Bank of Baroda Results

The recent financial results have played a critical role in shaping investor sentiment. BOB’s quarterly results indicated steady growth in revenue and profitability. However, concerns over asset quality and provisioning for non-performing assets (NPAs) have weighed on the stock’s performance. Investors are closely monitoring these results to gauge the bank’s future trajectory.

Bank of Baroda News

Recent news developments have also influenced the share price. Reports about regulatory changes, economic policies, and the bank’s involvement in key government initiatives have attracted attention. For example, BOB’s participation in the “Digital India” initiative and its focus on expanding its digital banking services are expected to be long-term growth drivers.

Historical Performance of Bank of Baroda Shares

Analyzing the historical performance of BOB shares provides valuable insights:

Over the last year, the stock has fluctuated between its 52-week high of ₹299.70 and 52-week low of ₹190.70.

The stock’s price trend reflects both macroeconomic factors and sectoral dynamics within the banking industry.

Share Price Targets

Short-Term Target (Next Week)

Based on technical analysis and market sentiment, the Bank of Baroda share price target for next week is estimated to range between ₹220 and ₹235, depending on market conditions and trading volumes.

Medium-Term Target (2025)

For the medium term, analysts project the Bank of Baroda share price target for 2025 to be in the range of ₹300 to ₹350, driven by expected improvements in profitability, digital banking adoption, and macroeconomic recovery.

Long-Term Target (2040)

Looking further ahead, the Bank of Baroda share price target for 2040 could reach ₹800 or more, provided the bank continues its focus on innovation, operational efficiency, and expansion into new markets.

Comparison with Peers: Polycab and Other Players

Polycab India Limited, a leading manufacturer of wires and cables, is often compared with BOB in terms of market dynamics and investment opportunities. While Polycab focuses on the manufacturing sector, BOB’s strength lies in financial services. Both companies represent growth stories in their respective sectors, offering diverse investment options.

Technical Analysis of Bank of Baroda Share Price

Support Levels: ₹220 and ₹215

Resistance Levels: ₹235 and ₹240

RSI (Relative Strength Index): Indicates the stock is nearing oversold territory, suggesting potential buying opportunities for long-term investors.

Key Factors Influencing Bank of Baroda Share Price

Economic Environment: Interest rate trends, inflation, and GDP growth impact BOB’s performance.

Regulatory Changes: Policies from the Reserve Bank of India (RBI) and government initiatives play a significant role.

Technological Advancements: The bank’s investments in digital infrastructure are expected to yield positive results over time.

Global Factors: Geopolitical developments and global financial trends also affect market sentiment.

Why Invest in Bank of Baroda Shares?

Investors consider BOB shares for their potential to deliver stable returns, backed by the bank’s:

Extensive network and market reach

Strategic initiatives to reduce NPAs

Focus on digital transformation

Dividend yield offering steady income

The Bank of Baroda share price continues to be a subject of keen interest among market participants. While short-term volatility may create challenges, the bank’s strong fundamentals and long-term growth prospects make it an attractive option for investors. Keeping an eye on financial results, regulatory developments, and market trends will be crucial for making informed investment decisions.

What is the current Bank of Baroda share price?

As of May 6, 2025, the share price is ₹223.50.

What is the Bank of Baroda share price target for 2025?

The share price target for 2025 is projected to be between ₹300 and ₹350.

Is Bank of Baroda a good investment?

BOB is considered a good investment for those seeking long-term growth and steady dividends, but it’s essential to assess market conditions and risk factors.

How has Bank of Baroda performed historically?

The stock has shown resilience, with fluctuations influenced by macroeconomic and sectoral factors. Its 52-week high and low are ₹299.70 and ₹190.70, respectively.

What are the key drivers for BOB’s share price growth?

Key drivers include economic recovery, digital banking initiatives, asset quality improvement, and favorable regulatory changes.